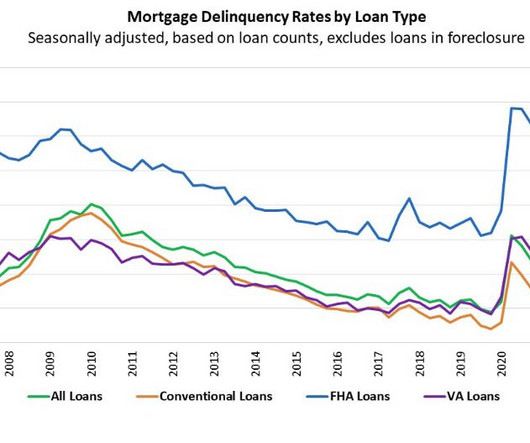

Cause for concern? FHA, VA delinquencies are rising quickly

Housing Wire

FEBRUARY 6, 2025

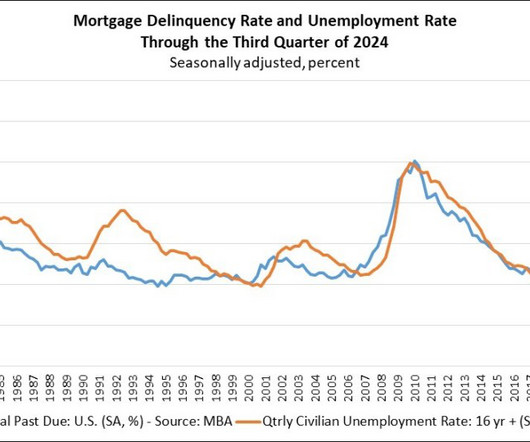

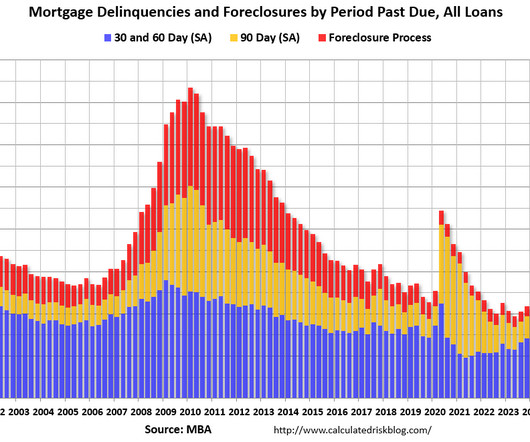

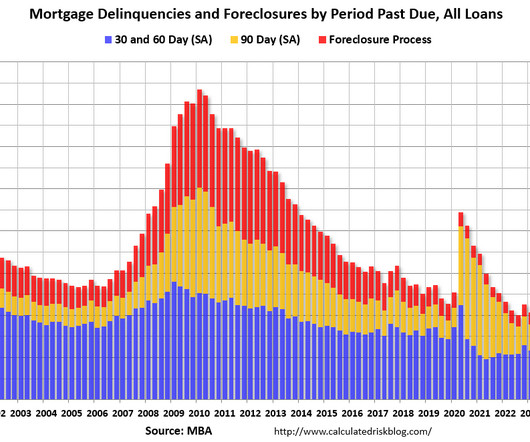

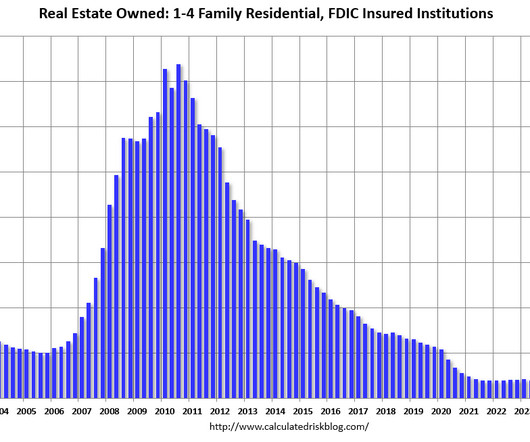

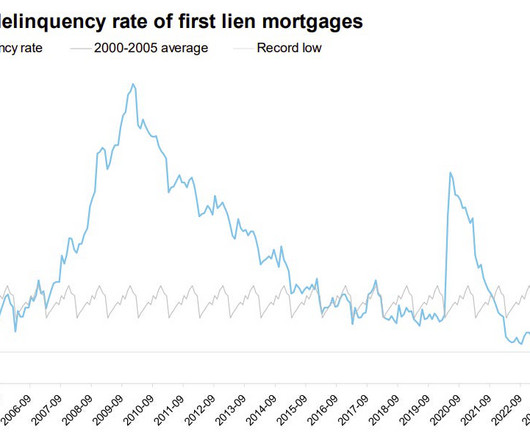

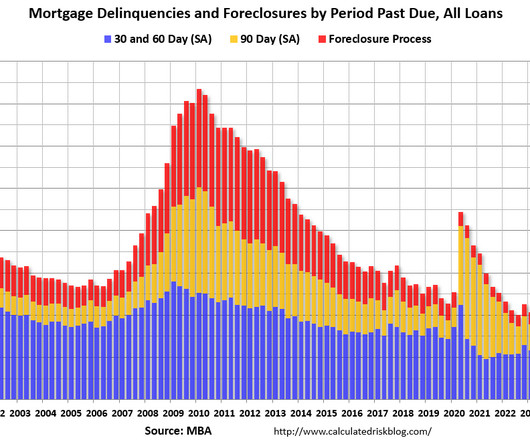

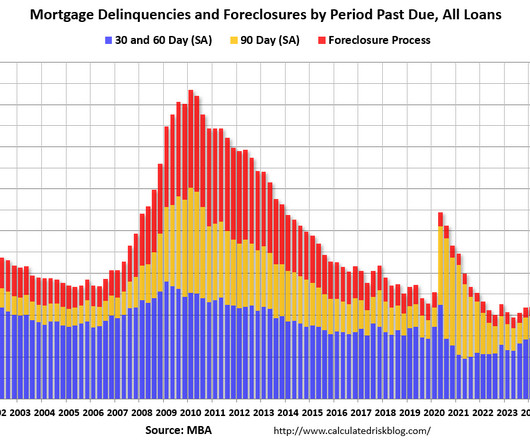

The seriously delinquent rate (loans that are at least 90 days overdue, plus those in foreclosure) for FHA loans is 4.12%, roughly three times higher than the 1.14% rate for conventional loans. The seasonally adjusted mortgage delinquency rate for all outstanding loans increased compared to the third quarter of 2024.

Let's personalize your content