Despite moratoria, foreclosures increase 20% in October

Housing Wire

NOVEMBER 11, 2020

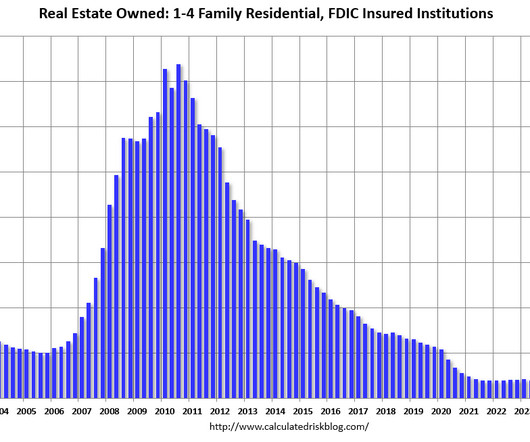

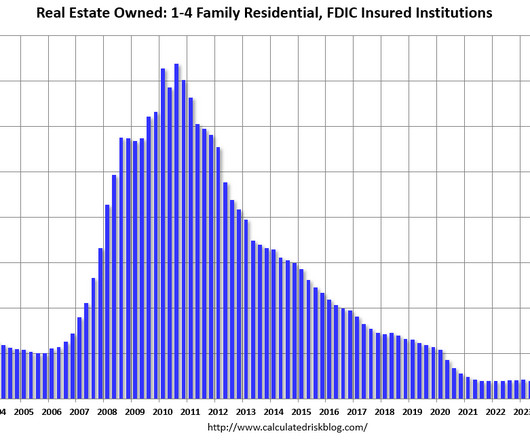

It’s likely that many of these properties were already in the early stages of default prior to the pandemic, or are vacant and abandoned, which makes them candidates for expedited foreclosure actions.”. Bank repossessions on REO homes (real-estate owned) were also up 28% from last month for a total of 2,577 U.S

Let's personalize your content