Have we found the bottom in existing home sales?

Housing Wire

DECEMBER 21, 2022

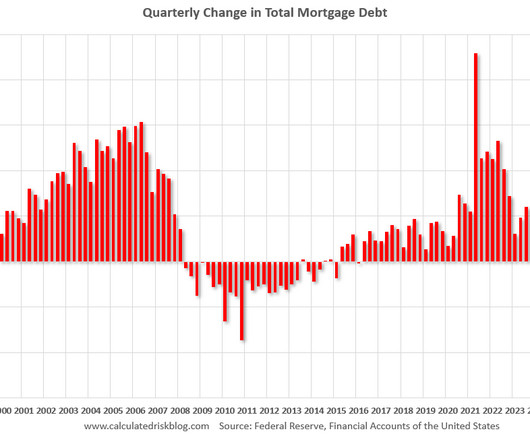

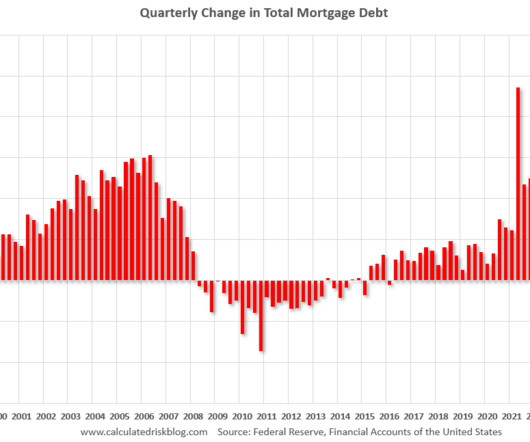

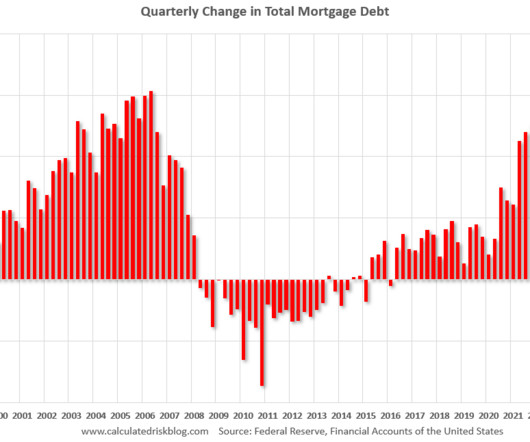

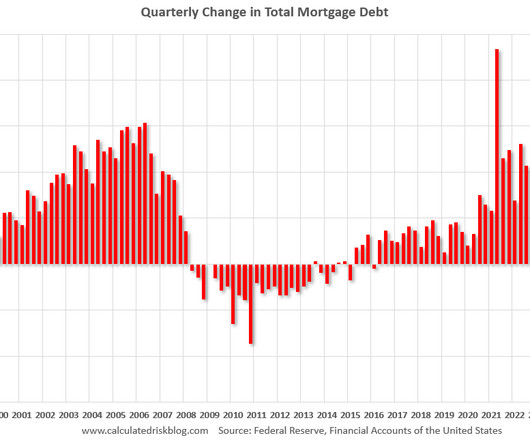

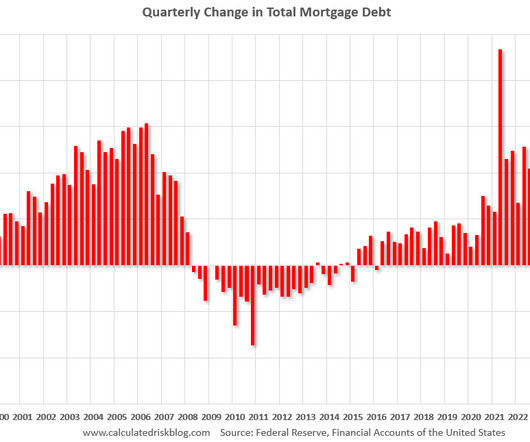

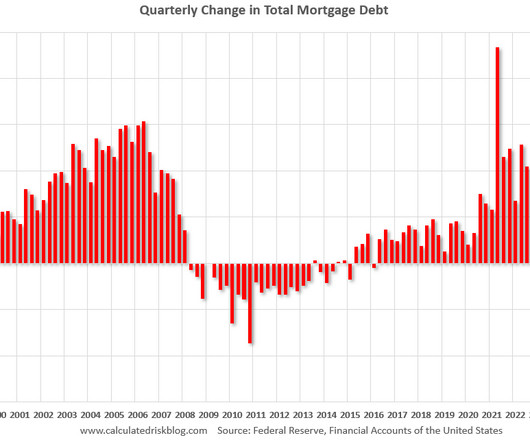

On Wednesday, existing home sales collapsed near the lows we saw during COVID-19 and back in 2007 when the housing bubble burst. “The principal factor was the rapid increase in mortgage rates, which hurt housing affordability and reduced incentives for homeowners to list their homes. From NAR: Total existing-home sales waned 7.7%

Let's personalize your content