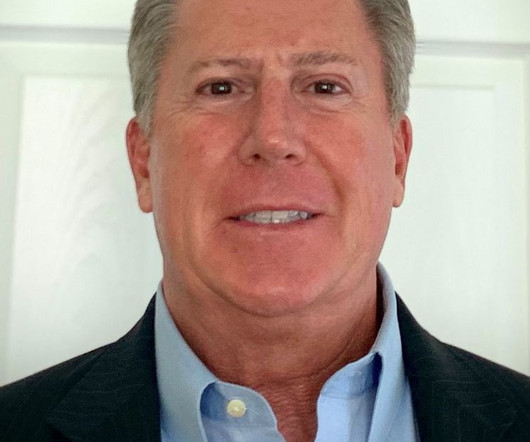

Maverix Advisory Group adds Kevin Van Eck as principal

Housing Wire

FEBRUARY 24, 2025

Van Eck will assume the role of principal after a 16-year tenure at @properties. Maverix Advisory Group has added industry veteran Kevin Van Eck to its leadership roster. He served in multiple positions there, most recently as president of affiliate strategy at Christies International Real Estate, which was acquired by @properties in 2021.

Let's personalize your content