Milo launches a crypto mortgage product

Housing Wire

JANUARY 18, 2022

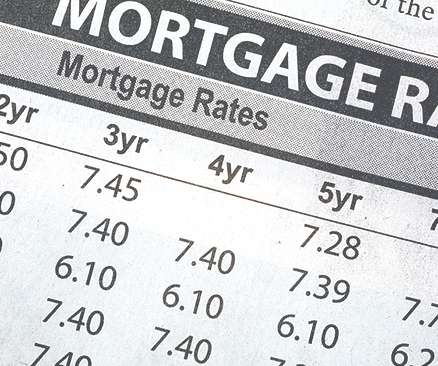

Milo , a Miami-based digital lender, will soon offer a crypto mortgage to clients with digital assets. If a client qualifies, they will receive a low interest rate 30-year crypto mortgage, the company said. And unlike conventional mortgages, there are no down payment requirements.

Let's personalize your content