Home sale cancellations hit record high in January

Housing Wire

FEBRUARY 28, 2025

Home sale cancellations in the U.S. The figure, which represents over 41,000 failed home-purchase agreements, marks an increase from 13.4% The trend is most pronounced in Atlanta, Las Vegas, Houston, and parts of Florida , where increasing housing supply is leading to a buyers market. home-sale price rising 4.1%

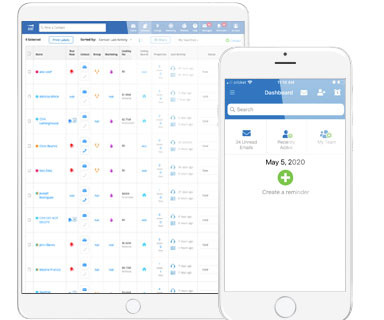

Let's personalize your content