Cause for concern? FHA, VA delinquencies are rising quickly

Housing Wire

FEBRUARY 6, 2025

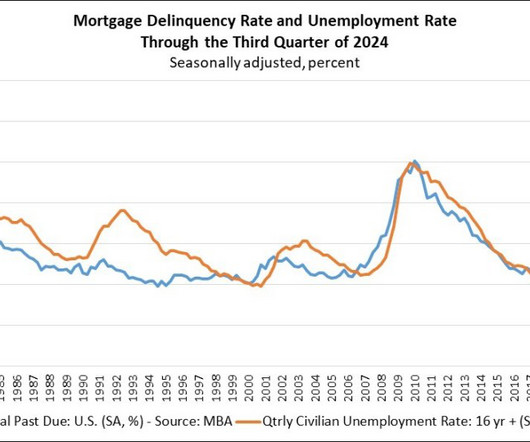

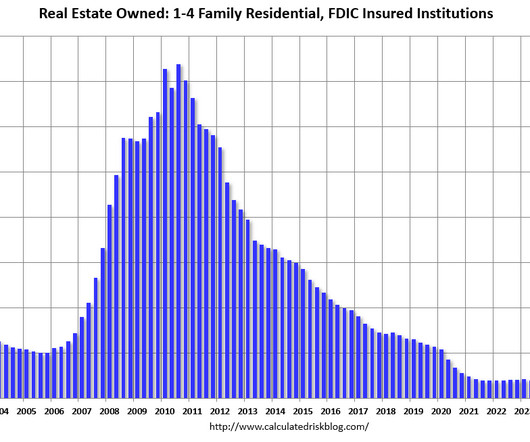

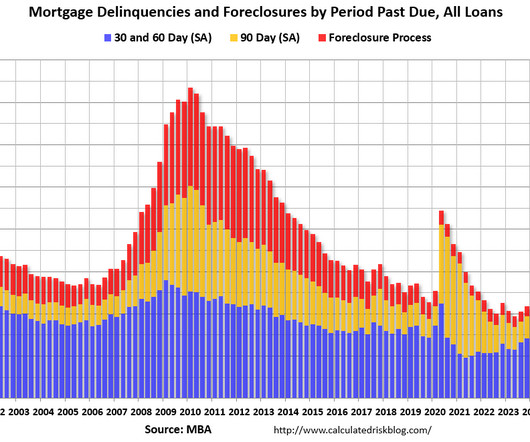

New data released Thursday by the Mortgage Bankers Association (MBA) revealed that the delinquency rate for mortgages on one- to four-unit residential properties increased to a seasonally adjusted rate of 3.98% of all loans outstanding at the end of 2024. Department of Veterans Affairs loans.

Let's personalize your content