A new source of affordable housing inventory: Private seller auctions

Housing Wire

MARCH 6, 2025

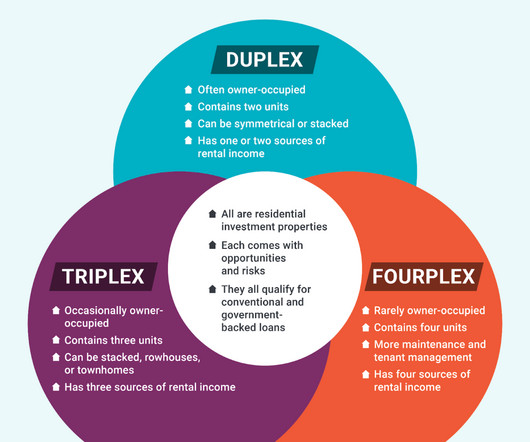

Tony Richards recently purchased four properties in his hometown of Montgomery, Alabama. He bought it from an outside landlord who didnt have the local market knowledge or presence needed for property management. All four of the properties are in underserved neighborhoods as defined by the Federal Housing Finance Agency (FHFA).

Let's personalize your content