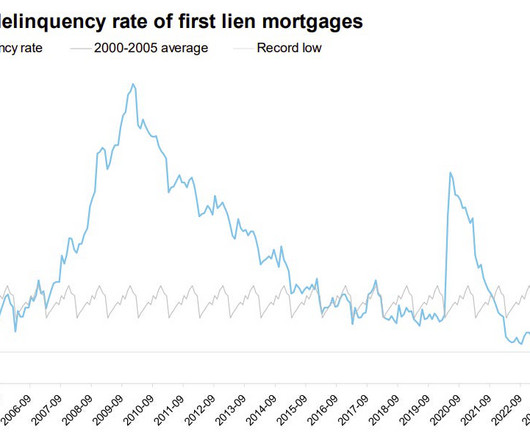

Loans in forbearance gain after 6 weeks of decline

Housing Wire

OCTOBER 2, 2020

million homeowners remain in COVID-19-related forbearance plans representing $751 billion in unpaid principal. According to the report, the portfolio-held and private labeled security loans were largely responsible for the recent increase, with forbearance share gaining from 7.1% to 7.3% – a total of 28,000 new loans in forbearance.

Let's personalize your content