How online auctions deliver on the promise of pre-foreclosure sales

Housing Wire

FEBRUARY 1, 2021

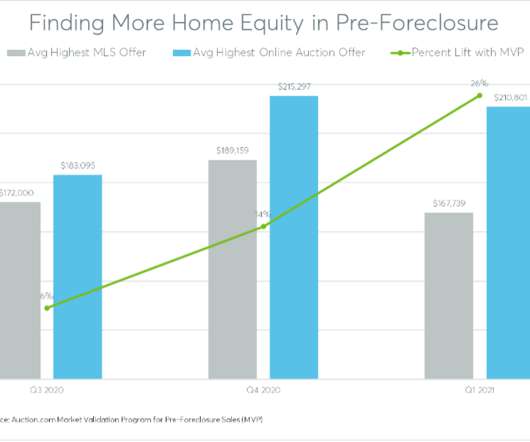

The great promise of short sales and other distressed pre-foreclosure sales as a foreclosure alternative is most fully realized in a competitive and transparent online auction marketplace, according to recent data from the Auction.com Market Validation Program (MVP) for pre-foreclosure sales. More than 45% of the 1.7

Let's personalize your content