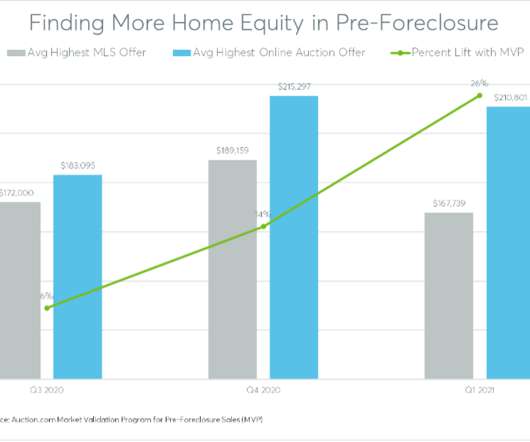

A transparent foreclosure marketplace reveals hidden equity

Housing Wire

APRIL 8, 2021

If a property reverts back to the foreclosing lender at the foreclosure sale and becomes real estate owned (REO), the distressed homeowner is not due any surplus proceeds from a subsequent sale of the REO property.”. But if it’s an Auction.com property, I actually pay a little more attention to it.”.

Let's personalize your content