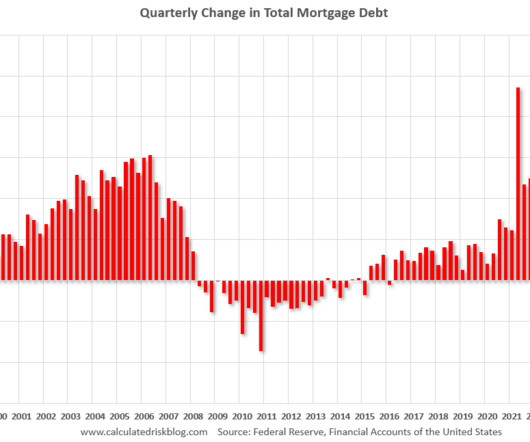

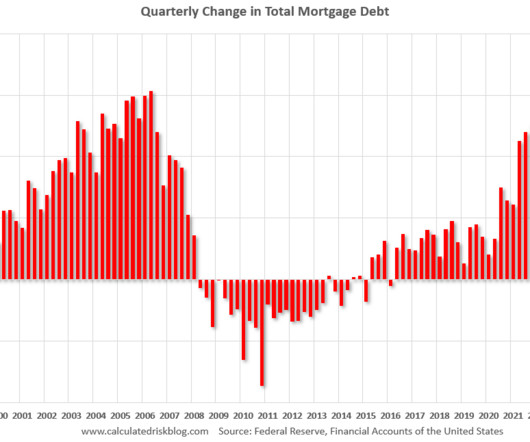

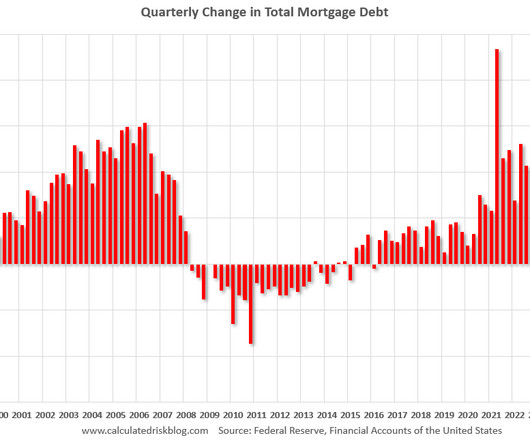

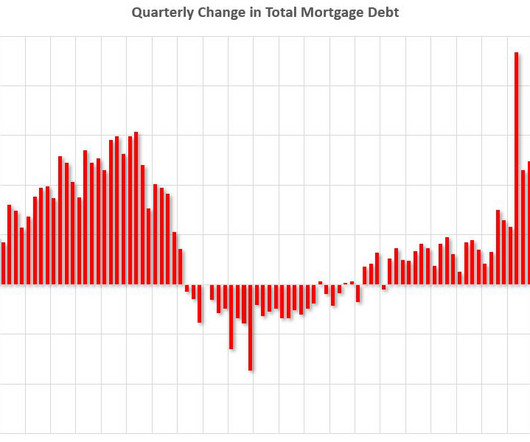

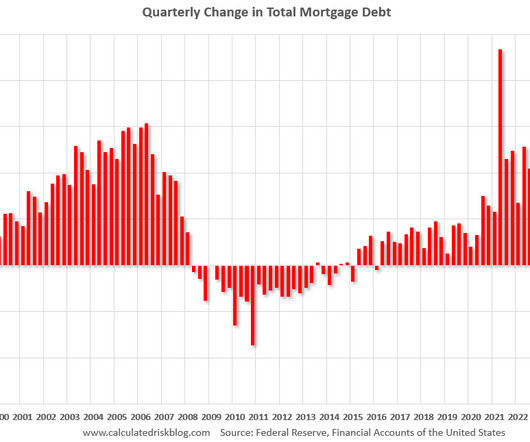

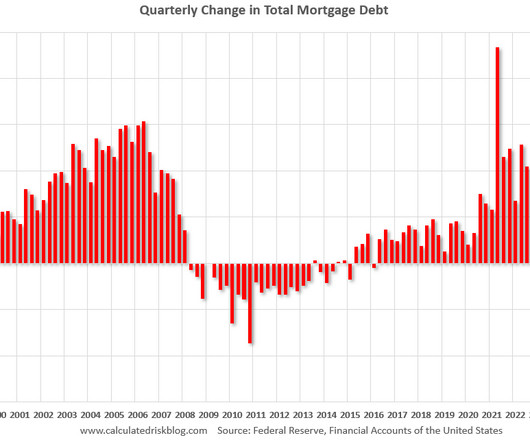

The "Home ATM" Stays Mostly Closed in Q2

Calculated Risk Real Estate

SEPTEMBER 8, 2023

However, in mid-2022, homeowners switched to using home equity loans (2nd loans) to extract equity from their homes. There are few debt cancellations now, so little MEW suggests that normal principal payments offset equity borrowing in Q2. 1 (sometimes called the Flow of Funds report) released today.

Let's personalize your content