No Congress, no rate hikes: Bill Ackman’s plan to privatize the GSEs

Housing Wire

APRIL 17, 2025

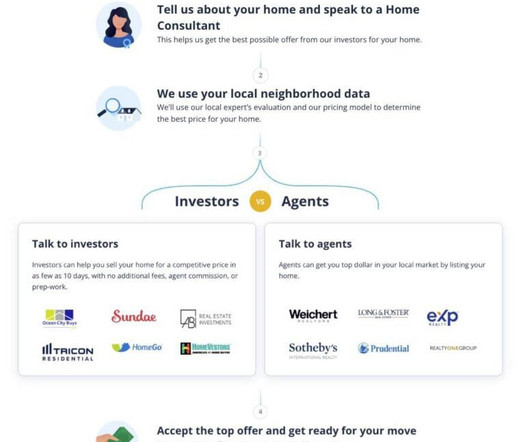

Bill Ackman, the billionaire founder of Pershing Square Capital Management , has an audacious plan to privatize Fannie Mae and Freddie Mac without congressional approval. Every sophisticated fixed-income investor will conclude that these are incredible the guarantee is rock solid. capital.

Let's personalize your content