Working with buyers in the nation’s hottest housing market

Housing Wire

APRIL 13, 2021

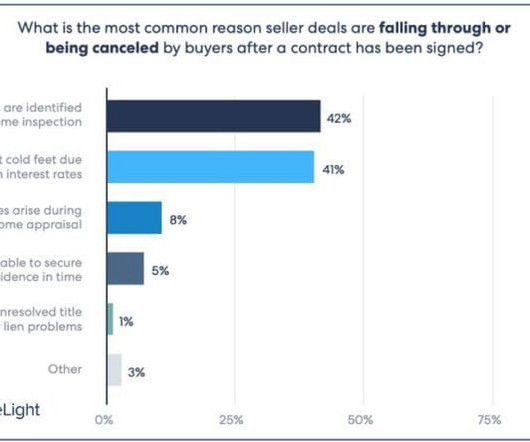

Richardson also noted that there have been fewer property inspection waivers issued by Fannie Mae in the last several months, keeping appraisers, inspectors and others in valuation very busy. One thing she does not recommend — unless the buyer is a builder or other very experienced player — is waiving the option period.

Let's personalize your content