Why the mortgage industry is poised for record M&A activity

Housing Wire

OCTOBER 31, 2022

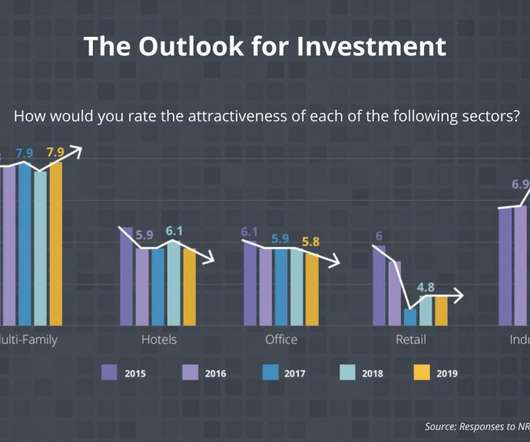

This is projected to be a record year for consolidation among mortgage lenders, largely due to the dramatic shift from a refinance boom to a purchase mortgage market and the total origination volume, which has shrunk to about half the size from 2021. Most recently, Guild Mortgage expressed interest in acquisitions.

Let's personalize your content