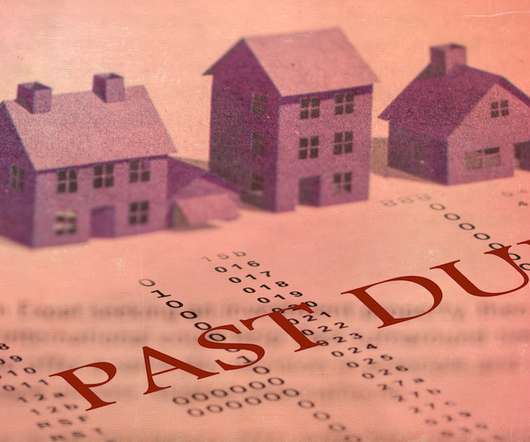

Navigating movement in the mortgage industry series: Post-closing matters are important too

Housing Wire

MARCH 3, 2025

Introduction As part of our ongoing discussion on the concept of movement in the mortgage industry, it is readily apparent that the failure of mortgage companies to pivot or tweak their business models to satisfy changing market and other conditions has resulted in consolidation based on liquidity, buyback, financial and other concerns.

Let's personalize your content