Fewer people are submitting mortgage applications

Housing Wire

JUNE 2, 2021

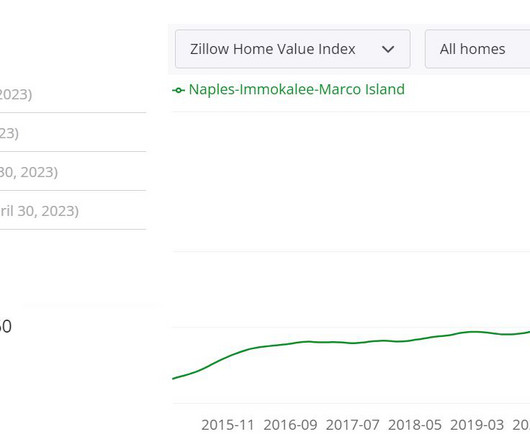

Tight housing inventory, obstacles to a faster rate of new construction, and rapidly rising home prices continue to hold back purchase activity,” Kan said. The post Fewer people are submitting mortgage applications appeared first on HousingWire.

Let's personalize your content