Trapped by design: Why America’s housing market is stuck — and what the rest of the world can teach us

Housing Wire

APRIL 10, 2025

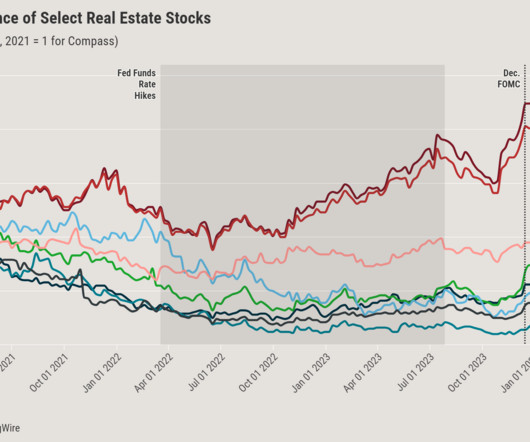

homeowners hold mortgages below 4%, according to the Federal Housing Finance Agency. With current rates hovering near 7%, selling a home today often means trading a historically low payment for one nearly double the size. And while U.S. The scale of the lock-in problem is staggering. Nearly two-thirds of U.S.

Let's personalize your content