‘Find buyers before agents!’ Mortgage industry reacts to the NAR settlement

Housing Wire

MARCH 15, 2024

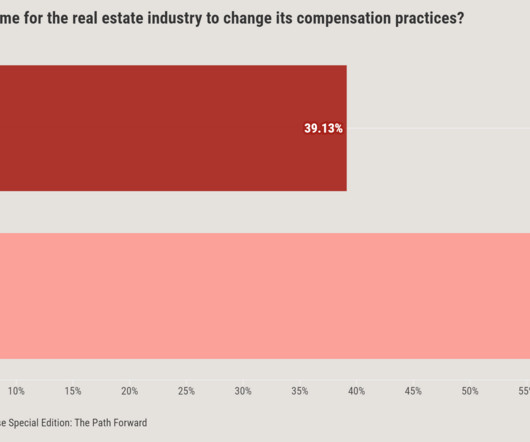

Also, fields displaying broker compensation on MLSs must be eliminated, there is a blanket ban on the requirement that agents subscribe to MLSs to offer or accept compensation and buyers’ agents must have written agreements. NAR said that the changes , if approved by the court, will go into effect in mid-July 2024.

Let's personalize your content