Mortgage demand for new homes is down 6.9% in the past year

Housing Wire

MARCH 13, 2025

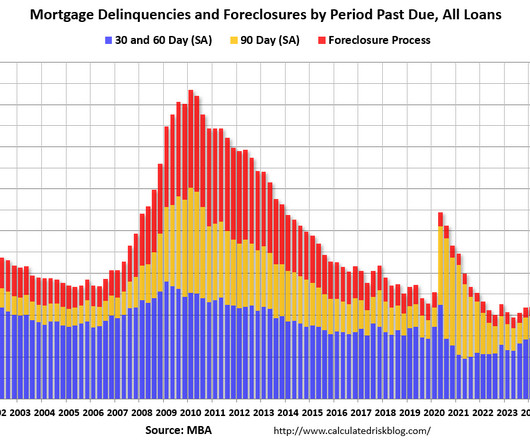

Mortgage applications for new-home purchases fell 6.9% year over year in February, according to data from the Mortgage Bankers Association (MBA)’s Builder Application Survey that was released Thursday. The average loan size decreased, signaling that first-time homebuyers remain active in the market, Kan said.

Let's personalize your content