Purchase applications continue growth streak this spring

Housing Wire

APRIL 2, 2025

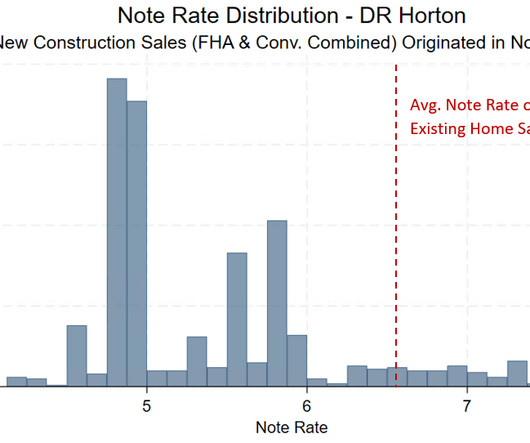

Overall purchase activity has shown year-over-year growth for more than two months as the inventory of existing homes for sale continues to increase, a positive development for the housing market despite the uncertain near-term outlook. For 30-year fixed-rate mortgages with jumbo loan balances, rates decreased to 6.76% from 6.77%.

Let's personalize your content