Mortgage applications for new construction climbed in August

Housing Wire

SEPTEMBER 14, 2023

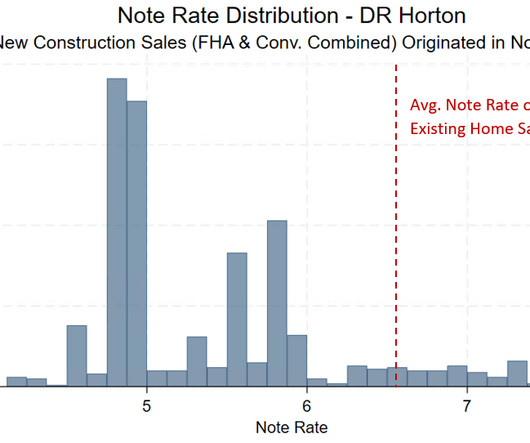

On an unadjusted basis, MBA estimates that there were 59,000 new home sales in August 2023, an increase of 5.4% from 56,000 new home sales in July. By product type, conventional loans made up 65.8% of loan applications. Meanwhile, FHA loans comprised 23.8%

.jpg)

Let's personalize your content