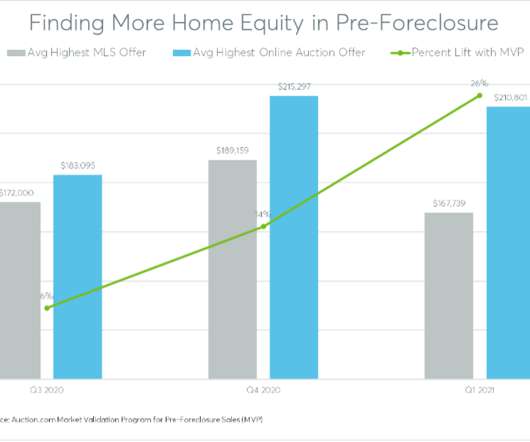

A transparent foreclosure marketplace reveals hidden equity

Housing Wire

APRIL 8, 2021

billion in potential home equity has been uncovered for distressed homeowners facing foreclosure. billion is the amount of surplus funds generated by foreclosure sales on the Auction.com platform between 2016 and 2020. The maximum allowable credit bid at foreclosure auction is the amount of total debt owed on the defaulted mortgage.

Let's personalize your content