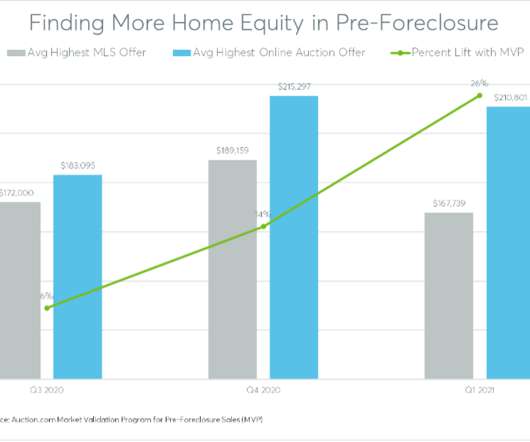

A transparent foreclosure marketplace reveals hidden equity

Housing Wire

APRIL 8, 2021

billion in potential home equity has been uncovered for distressed homeowners facing foreclosure. billion is the amount of surplus funds generated by foreclosure sales on the Auction.com platform between 2016 and 2020. Over the past five years, more than $1.2 What’s surprising is just how much surplus is being generated.

Let's personalize your content