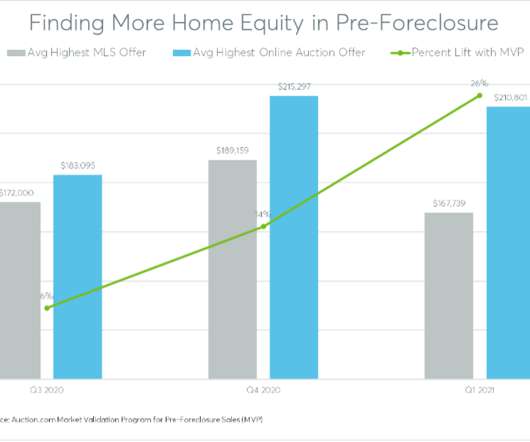

A transparent foreclosure marketplace reveals hidden equity

Housing Wire

APRIL 8, 2021

billion in potential home equity has been uncovered for distressed homeowners facing foreclosure. A foreclosure sale usually represents the last chance for a distressed homeowner to benefit from any equity in a property being foreclosed,” said Ali Haralson , Auction.com president. “If Over the past five years, more than $1.2

Let's personalize your content