Opinion: Is the time ripe for a third way to tap home equity?

Housing Wire

APRIL 9, 2024

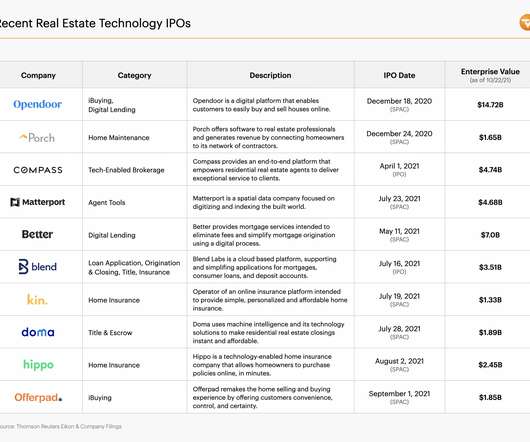

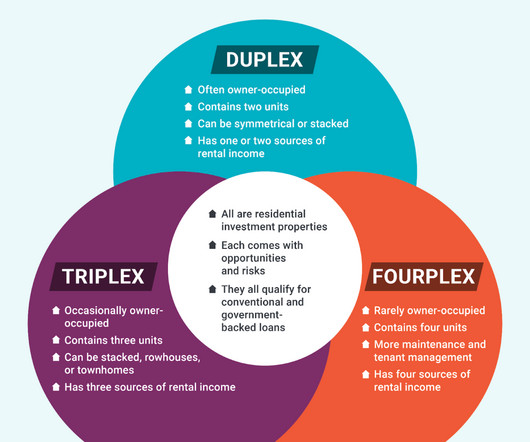

The convergence of homeowner requirements and investor incentives has resulted in a genuine inflection moment for home equity investments (HEIs). Are home equity investments the answer? In simple terms, home equity investments offer homeowners a way to unlock equity without taking on monthly payments or additional debt.

Let's personalize your content