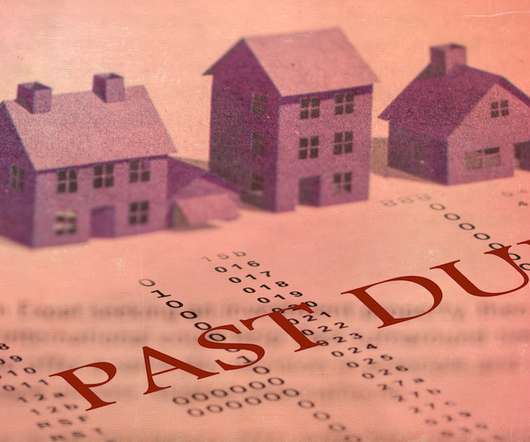

The biggest challenge for the reverse industry in 2024? Mortgage rates

Housing Wire

DECEMBER 27, 2024

That was a repeated idea shared by a group of reverse mortgage professionals when asked to assess what they see as the biggest industry challenges of the year. But despite challenges posed by rates, industry professionals continue to find a way forward. I think that’s true from an industry standpoint.

Let's personalize your content