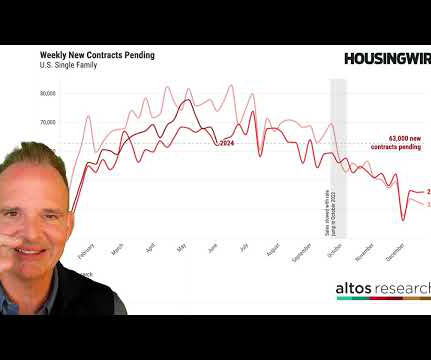

More listings, lower rates should boost 2025 sales: Fannie Mae

Inman

JUNE 24, 2024

Fannie Mae on Friday slashed its 2024 forecast as a result of weak spring home sales, but listings are returning to the market and mortgage rates look poised to drop, according to new projections.

Let's personalize your content