Most Home Purchase Agreements Are Contingent on These Two Items

HomeLight

JANUARY 10, 2024

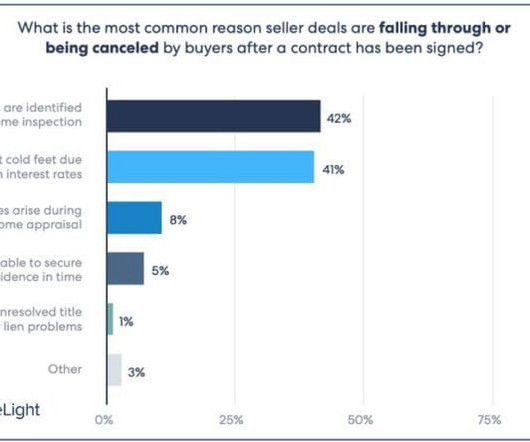

Most purchase agreements are contingent on two key items: home inspection and financing. In the world of real estate, a contingent offer on a home means that the purchase is conditional upon certain terms being met. Most purchase agreements are contingent on which two items? What does this mean to a seller?

Let's personalize your content