From consultation to closing: The definitive homebuying checklist

Housing Wire

FEBRUARY 19, 2025

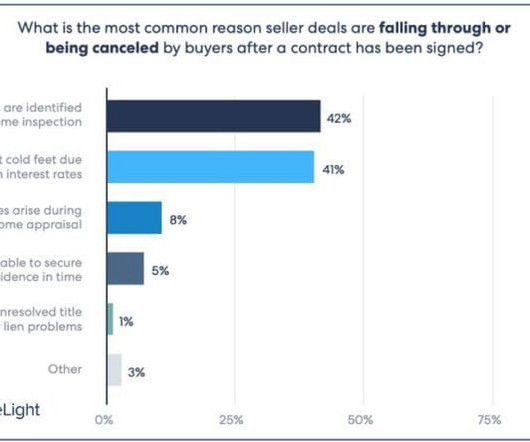

Secure a mortgage pre-approval As a rule of thumb, its best to have your clients obtain a mortgage pre-approval prior to setting up any searches and conducting property tours. Do your due diligence: Protect client interests The due diligence period is the time when the buyer conducts inspections to verify the condition of the property.

Let's personalize your content