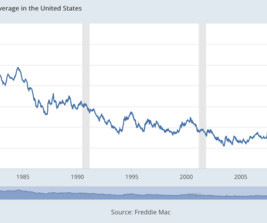

What’s behind the sharp decline in mortgage delinquencies?

Housing Wire

SEPTEMBER 16, 2021

When it comes to housing and mortgage markets this fall, most attention is being focused on the expiration of eviction and foreclosure moratoria and the pending completion of forbearance terms for many homeowners. Only 0.65% of exits to date have been into other resolutions, which would include short sales and deed-in-lieus.

Let's personalize your content