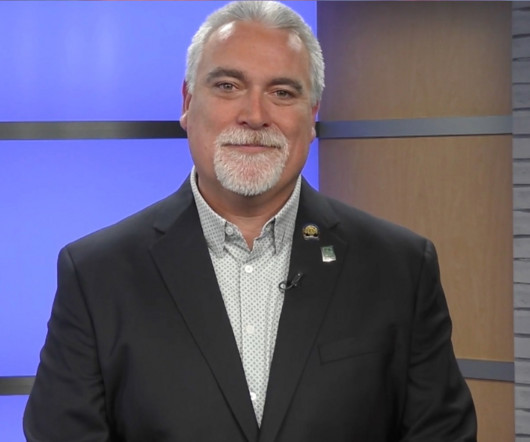

Patton Gade, top LO for VA loans, heads to UMortgage

Housing Wire

OCTOBER 24, 2023

Patton Gade, the top producing loan officer for VA home loans in the U.S. Military Academy at West Point, will continue to originate loans and hold the national director of military lending position at UMortgage. He’ll join forces with fellow veteran loan originator Jay Bunte in the brokerage firm.

Let's personalize your content