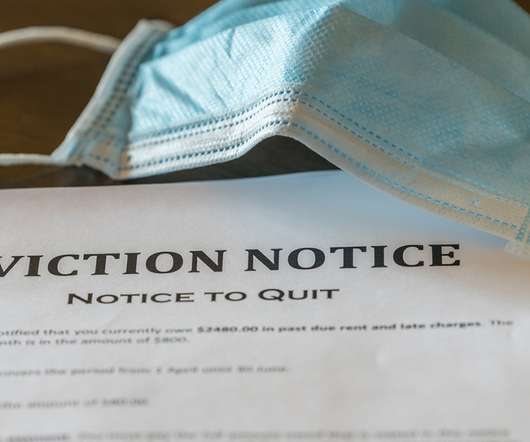

Housing coalition publishes recommendations for GSEs’ ‘Duty to Serve’ plans

Housing Wire

FEBRUARY 7, 2024

mortgage finance system. The GSEs should “increase certain loan purchases” in Duty to Serve markets; develop new and accessible loan products and programs; and evaluate new business partnership opportunities. Better loan products to serve “high-needs rural regions” should also be developed.

Let's personalize your content