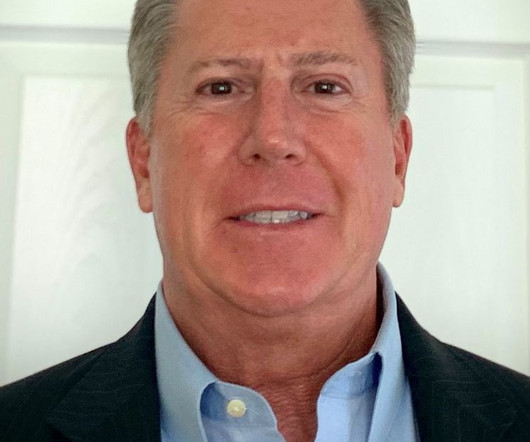

Home equity access: How Finance of America bolsters the market with home equity products

Housing Wire

NOVEMBER 20, 2024

In today’s economy, mortgage rates and housing expenses have consistently risen. However, homeowners have a unique advantage with home equity products—designed to let residents tap into their home’s equity for cash. That growth presents an opportunity for reverse mortgages and home equity loans.

Let's personalize your content