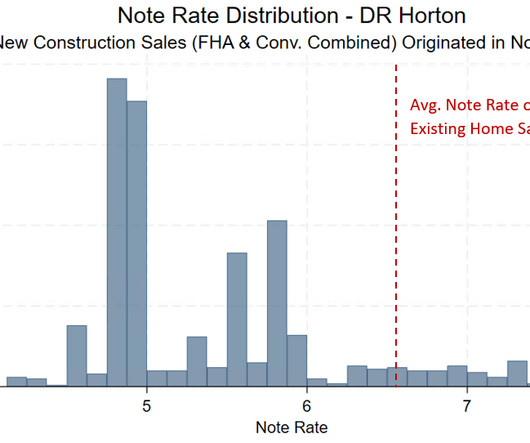

More homebuyers seek government-backed loans as an affordability lifeline

Housing Wire

FEBRUARY 3, 2025

Affordability is a real challenge right now, and with the fact that FHA and VA loans require a lower down payment, and allow for the debt-to-income ratio to go higher than conventional, these types of loans are the bulk of what we are seeing in the market right now. He noted that despite a national slowdown in home sales , St.

Let's personalize your content