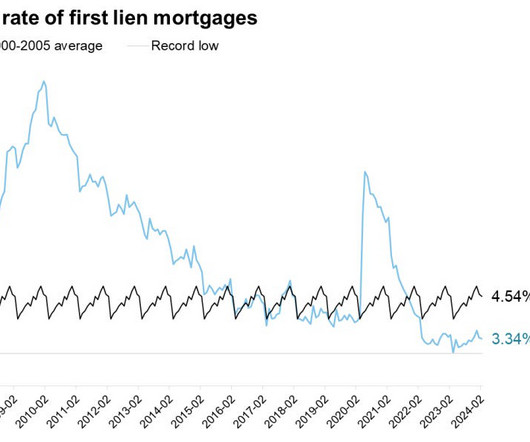

Today’s Mortgage Rates March 20, 2025: Rates Rise Marginally This Week

Marco Santarelli

MARCH 20, 2025

VA Loans – A Benefit for Veterans: Backed by the Department of Veterans Affairs, VA loans offer significant advantages to eligible veterans, active-duty service members, and surviving spouses. These loans often come with no down payment requirements and competitive interest rates.

Let's personalize your content