5 tips for finding the right mortgage lender for you

Housing Wire

JANUARY 20, 2021

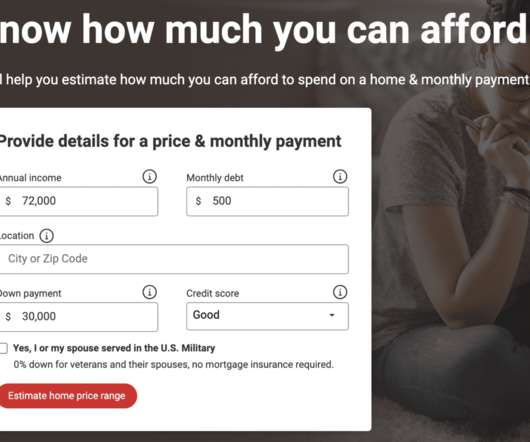

And not just research on the best down payment or neighborhood to live in – you should also search the right mortgage lender. . The type of mortgage loan you qualify for is just as important as the mortgage lender you work with. The good news, it’s easy to find a mortgage lender. Buying a home?

Let's personalize your content