Agency loan-repurchase strategy sparks pushback

Housing Wire

MAY 9, 2023

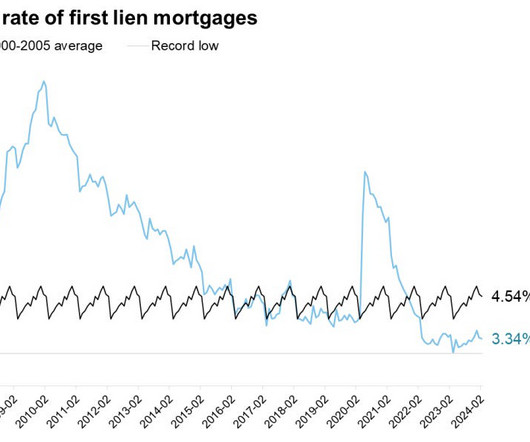

Independent mortgage banks have been coping with a still-surging wave of loan-repurchase requests from Fannie Mae and Freddie Mac that represents yet another threat to lenders’ already stretched balance sheets. Those loans are going to be 20 points underwater, for the 3% to 3.5%

Let's personalize your content