The impact of student loans on buying a home

Housing Wire

MAY 24, 2024

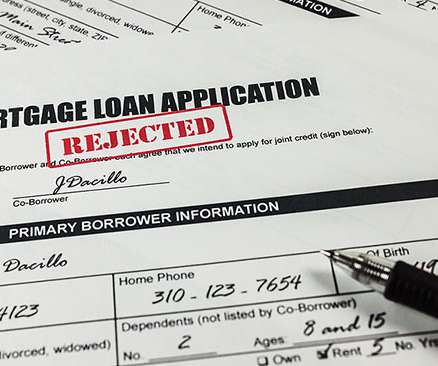

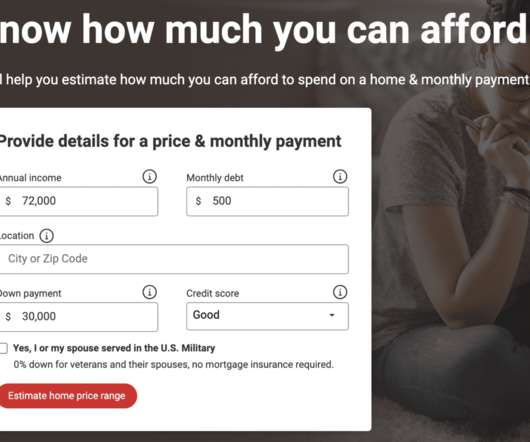

Nearly 1 in 5 millennials (19%) think their credit card debt will be a stumbling block when applying for a mortgage, while 1 in 7 (14%) think the same about their student loans. How student loans impact your ability to buy a home Adding a mortgage on top of monthly student loan payments can create a significant financial strain.

Let's personalize your content