Unison unveils ‘hybrid’ home equity sharing loan

Housing Wire

SEPTEMBER 17, 2024

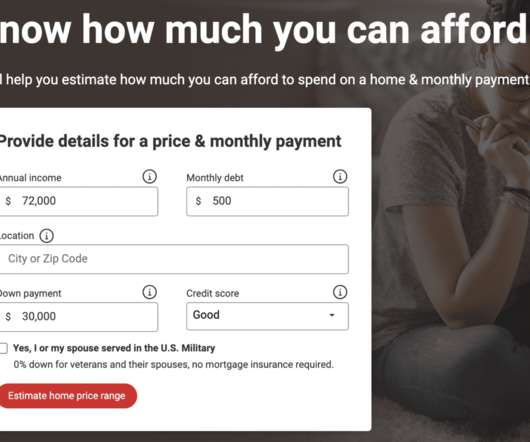

The product is a second mortgage with a below-market interest rate that allows a homeowner to tap into their equity without refinancing their existing mortgage. With lower monthly payments, made possible by shared home appreciation, homeowners can confidently pursue their financial goals with peace of mind.”

Let's personalize your content