Builders rediscover a tool from the 1980s that keeps new home prices from falling

Housing Wire

DECEMBER 12, 2023

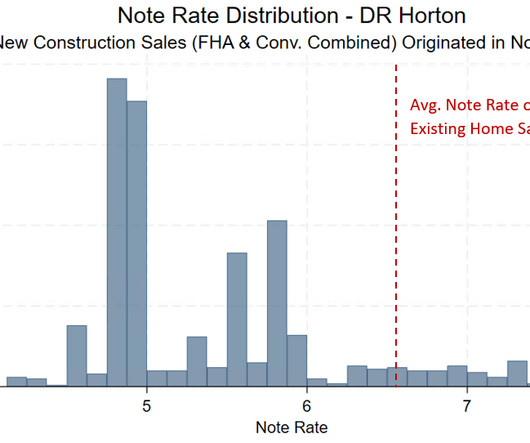

To overcome these headwinds, builders quickly turned to lowering mortgage rates through permanent rate buydowns — a tool last widely used in the early 1980s when the rates exceeded 12%. This phenomenon becomes clearly apparent when compared to existing home sales, for which these buydowns are very rare.

Let's personalize your content