Mortgage costs, lender denials jumped in 2022: CFPB

Housing Wire

SEPTEMBER 27, 2023

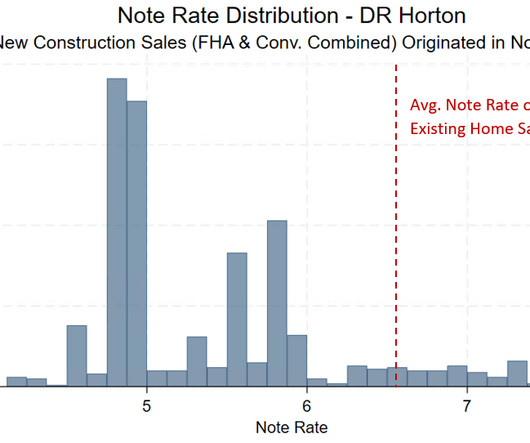

Homebuyers faced surging mortgage costs, fees and monthly payments in 2022 amid a tightening monetary policy designed to combat persistent inflation. And because their income didn’t keep up, lenders’ denials for a home loan jumped last year, according to a Consumer Financial Protection Bureau (CFPB) report released Wednesday.

Let's personalize your content