Positive signs abound for 2024 housing market: ICE

Housing Wire

FEBRUARY 5, 2024

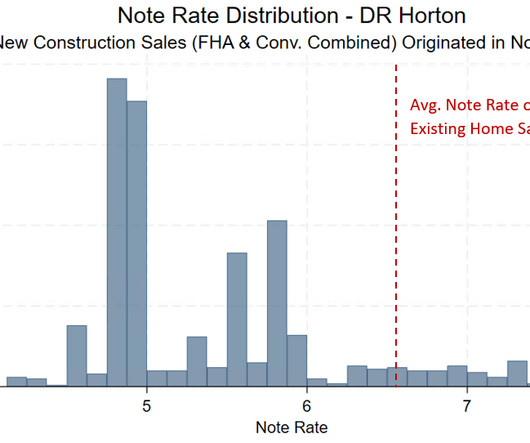

Recent market trends — including an improvement in mortgage rates, housing affordability and potential refinance opportunities — suggest positive signs for the real estate market this year, according to February’s Mortgage Monitor report from Intercontinental Exchange (ICE). peak prior to the housing market downturn in 2006. “If

Let's personalize your content