More homebuyers seek government-backed loans as an affordability lifeline

Housing Wire

FEBRUARY 3, 2025

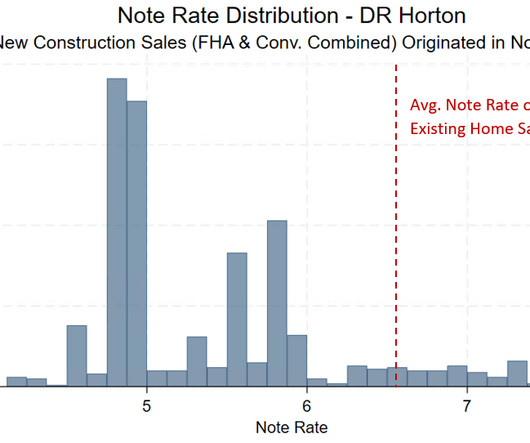

The combined cost of mortgages, taxes and insurance now takes up a larger share of household income than it has since the early 1980s, according to an affordability index from John Burns Research & Consulting. Department of Veterans Affairs (VA) loans, which made up 10%, according to purchase loan lock data from Optimal Blue.

Let's personalize your content