A San Diego data dive shows a market upended by tight supply

Housing Wire

FEBRUARY 28, 2024

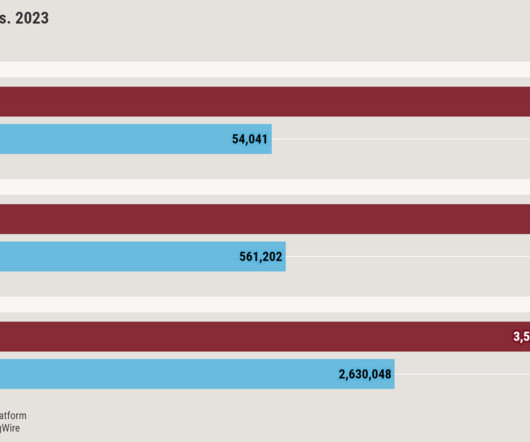

The data examined below represents multiple listing service data and mortgage market analytics for San Diego County, as well as the state of California and the country as a whole from 2019 to 2023. Mortgage data paints a similar picture of the increasing competitiveness of the San Diego market.

Let's personalize your content