Buyers are being picky — here’s how you can navigate it as a real estate agent

Housing Wire

JANUARY 23, 2024

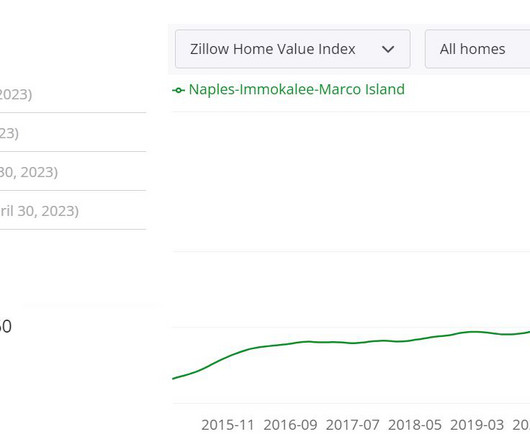

home sales in nearly 30 years as high mortgage rates frustrate buyers, the market is reshaping real estate once again, placing buyers on the back foot and swinging the pendulum back to favoring sellers. The changing tides Previously, buyers were able to look for over a month, as average days on market continued to climb.

Let's personalize your content