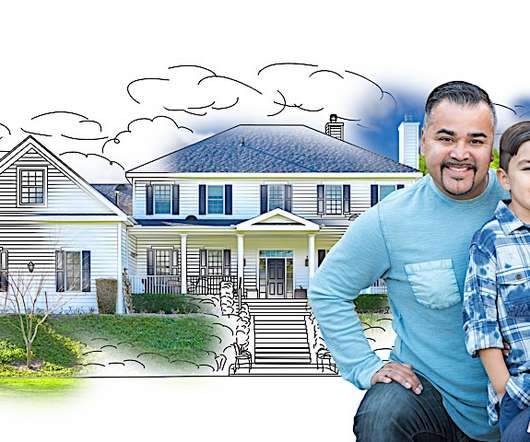

Portrait of a pre-foreclosure peacemaker

Housing Wire

OCTOBER 24, 2024

Many of the distressed properties Sandoval encounters are not in good enough condition to qualify for traditional financing. That means the buyer will need to pay in cash or use non-traditional financing such as a hard money loan. These scenarios are not like vanilla deals,” Sandoval said.

Let's personalize your content