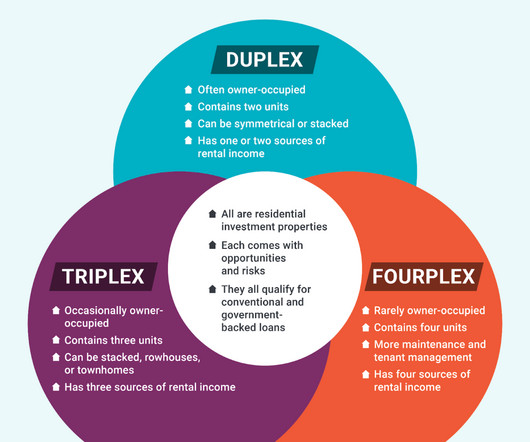

How to Buy a Multifamily Property in 10 Steps

The Close

NOVEMBER 25, 2024

Multifamily mortgage loans typically require 20% of the property price for a down payment, and there are inevitable maintenance and property management costs. The higher the home’s sale price, the higher your closing costs. The longer renovations take, the higher your carrying costs will be.

Let's personalize your content