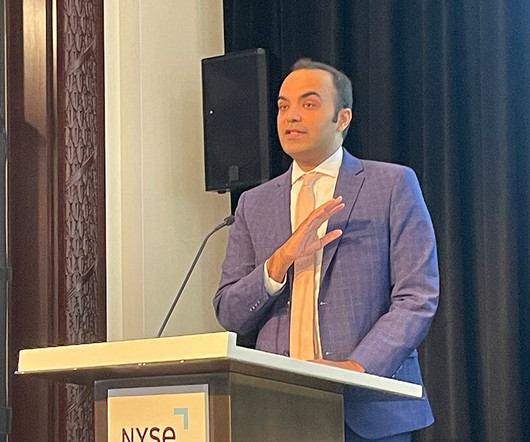

Encompass by ICE Mortgage Technology: A flexible end-to-end origination solution

Housing Wire

OCTOBER 21, 2024

The mortgage industry faces constant change. Encompass by ICE Mortgage Technology aims to provide a flexible end-to-end solution for lenders in a modern market. From origination to closing, it covers all lending channels in one system. They also reduced the time from application to closing by three days.

Let's personalize your content