Why non-QM borrowers aren’t going away anytime soon

Housing Wire

NOVEMBER 15, 2022

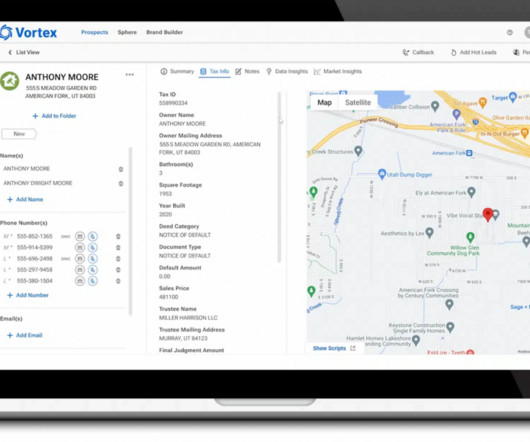

This significant pool of clients includes self-employed, real estate investors and those with credit events. Originators who actively work within the non-QM space are closing additional loans every month. Real Estate Investors: The volume of investment properties has outpaced the purchase of primary homes throughout 2022.

Let's personalize your content